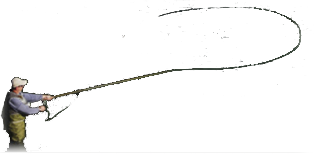

The sport fishing excise tax law changed on Sept 30th. With the old rules there was a 10% tax on all fishing gear over $100. So a $600 fly rod included a $55 tax, its pre tax value was $545. With the new rules the tax is capped at $10 for all gear over $100. So the new retail price of that $600 fly rod should be $555. Have prices come down or are we being quietly ripped off...FB.

Reply With Quote

Reply With Quote